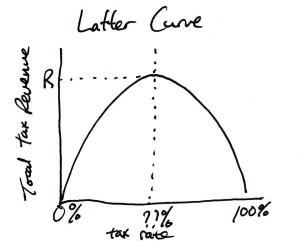

As I was researching tax policies to debate with friends, I came across the Laffer Curve. The Laffer Curve is a simple way of saying that past a certain tax rate, a higher tax rate does not mean higher tax revenue, and is the reasoning behind Reagan’s controversial trickle down economics. At a cursory glance, the curve didn’t make sense. Shouldn’t a higher tax rate correlate linearly with a higher tax revenue?

A great explanation of the curve was given by a you-tuber Mr. Clifford. Imagine a kid deciding whether or not to go trick or treating under the following scenarios. Scenario 1: the parents tax the kid 5% on his candy; the kid would go. Scenario 2: the parents tax the kid 50% on his candy; the kid would probably still go. Scenario 3: the parents tax the kid 95% on his candy; the kid wouldn’t go anymore. And even if he did, he would hide his candy. Thus the candy tax revenue that the parents collect would decrease as the candy tax rate increases up to 95%.

The scenario in which the kid hides the loot from his parents to avoid the 95% tax rate draws parallels to corporations avoiding their tax share through loopholes in the tax system. So what are these loopholes that supposedly allow even Warren Buffett to pay lower tax rates than his secretary?

Carried Interest

One of the infamous loopholes is known as carried interest. Carried interest is what people earn by managing other people’s money. A firm, or a general partner, manages private investment funds from limited partners and earns a compensation known as a carried interest. In the current law, general partners are taxed as if the compensation is long-term capital gain, which results in a lower tax rate (max 20%) compared to the tax rate of wages (max 39.6%).

The argument lies in which carried interest is really wage income because general managers aren’t risking their own money but their investors’ money. Why should billionaire hedge fund managers be allowed to pay tax rates lower than the rest of us that work for a salary?

In a venture capital partnership, the firm and the limited partners invest in businesses for often 5-10 years before seeing any profits, offering expertise to help the companies grow. Only when there is a return on the partnership do general managers get paid their carried interest, and only after the limited partners have received their promised share. The low tax rate of carried interest exists because capital gains in venture capital partnerships are not guaranteed. This system allows businesses to get the funding they need and provides investors with incentives to take risks and provide expertise to see businesses grow.

Venture capital partnerships are necessary to fund businesses that stimulate our economy; they provide businesses with the funding they need. So wouldn’t raising tax rates for carried interest hurt investments in the future? Or has the tax rate dropped below the equilibrium in the Laffer Curve. Would investors still invest under a higher carried interest tax rate as Buffett claims they did in 1976?

Hurrah, that’s what I was looking for, what a information! existing here at this website, thanks admin of this site.

It’s amazing for me to have a web site, which is good designed for my experience.

thanks admin